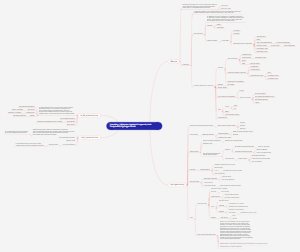

MindMap Gallery Substitution methods for the synthesis of cosmetic ingredients

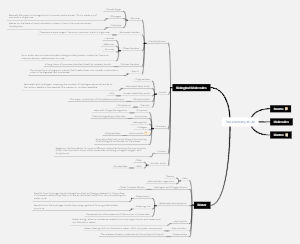

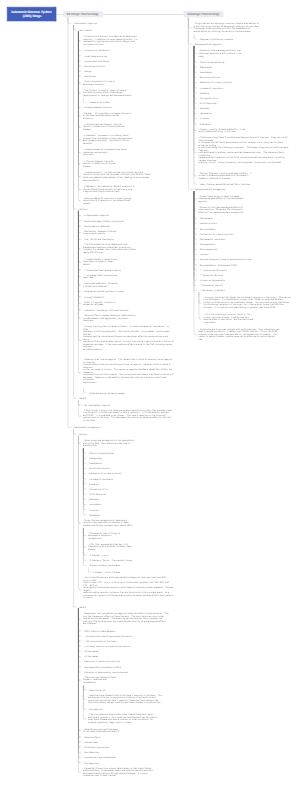

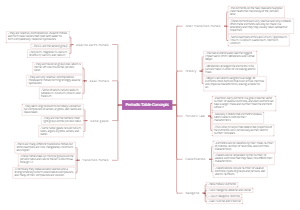

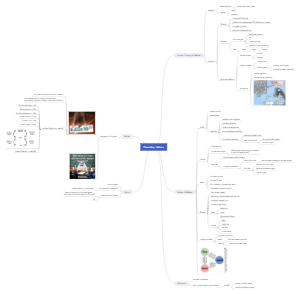

Substitution methods for the synthesis of cosmetic ingredients

Substitution methods are crucial in the synthesis of cosmetic ingredients, encompassing various types such as alkylation, acylation, and sulfonation. These methods boast high efficiency, good selectivity, and strong customizability, enabling the synthesis of cosmetic ingredients with specific functions. However, they also face challenges such as numerous byproducts, harsh reaction conditions, and environmental pollution, necessitating continuous optimization of processes to mitigate adverse effects.

Edited at 2024-12-17 02:36:21Substitution methods for the synthesis of cosmetic ingredients

- Recommended to you

- Outline