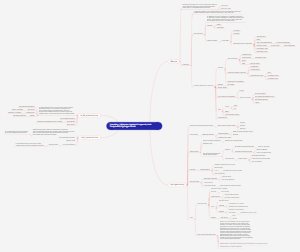

MindMap Gallery Chemists from the Philippines

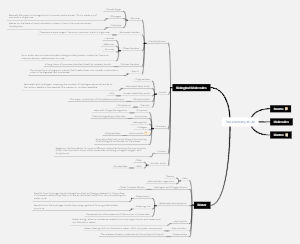

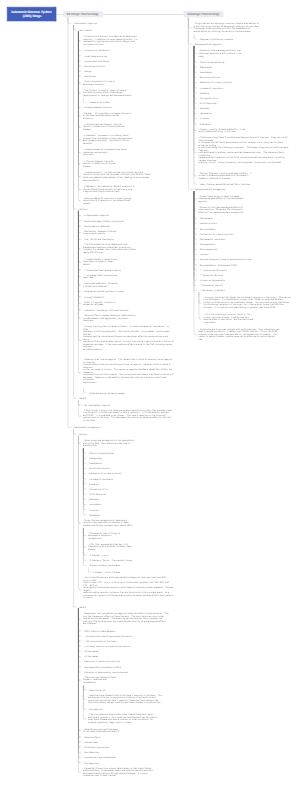

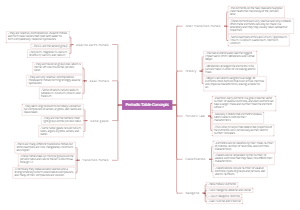

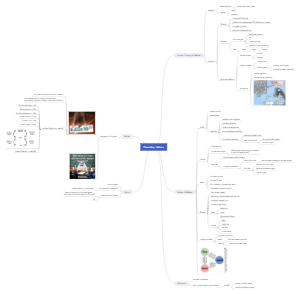

Chemists from the Philippines

Filipino chemists have a rich history and outstanding contributions in the field of chemistry. From early chemical enlightenment to the thriving development of modern chemical education, the research in chemistry in the Philippines has continuously made new breakthroughs. Many internationally renowned Filipino chemists have achieved significant accomplishments in their research fields, driving the progress of chemical science. Additionally, the Philippines demonstrates strong R&D capabilities in frontier areas such as green chemistry, drug discovery, and materials science.

Edited at 2024-12-17 08:37:23Chemists from the Philippines

- Recommended to you

- Outline