Debits and Credits: Simple Guide with Mind Map Examples

Understanding Debits and Credits lies at the center of understanding the essence of how finance and accounting functions. From an organization’s or a company’s point of view, it is used for bookkeeping to balance its books.

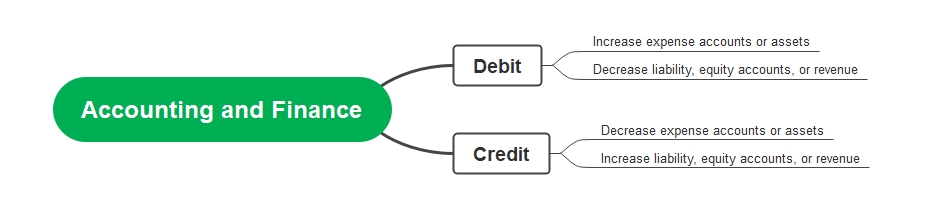

Debits increase expense accounts or assets and decrease liability, equity accounts, or revenue, whereas credit decreases expense accounts or assets and increases liability, equity accounts, or revenue. Whenever a transaction entry is recorded, for every debit entry recorded, the should be a corresponding credit entry recorded and/or vice-versa.

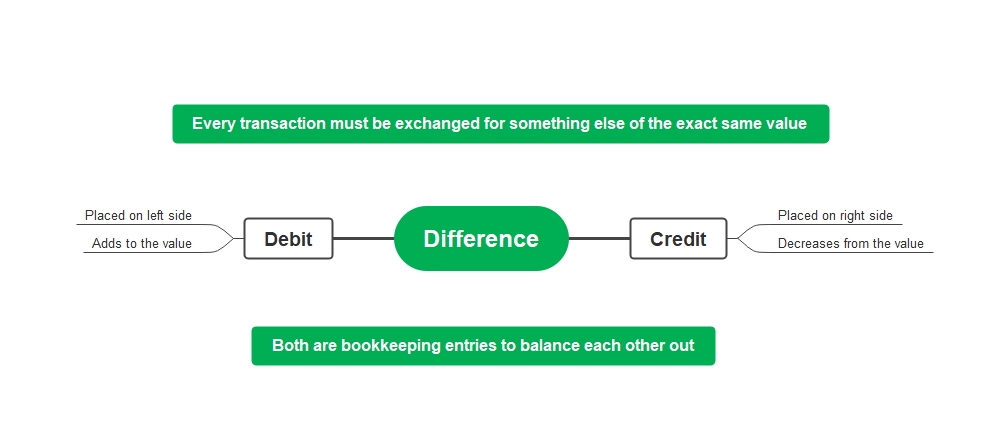

Think of Debits and Credits as bookkeeping entries that ultimately cancel or balance each other out. We can put it in layman’s as such, ’a debit entry adds a positive number to the book whereas credit adds negative number’. Though positive and negative signs are not actually used in journal entries, it is used metaphorically. In a bit more technical sense, every transaction must be exchanged for something else of the exact same value.

The debit is always positioned on the left hand, whereas credit is positioned on the right hand. We can summarize it all as all the money flowing into an account is debit, whereas all the money flowing out of an account is debit.

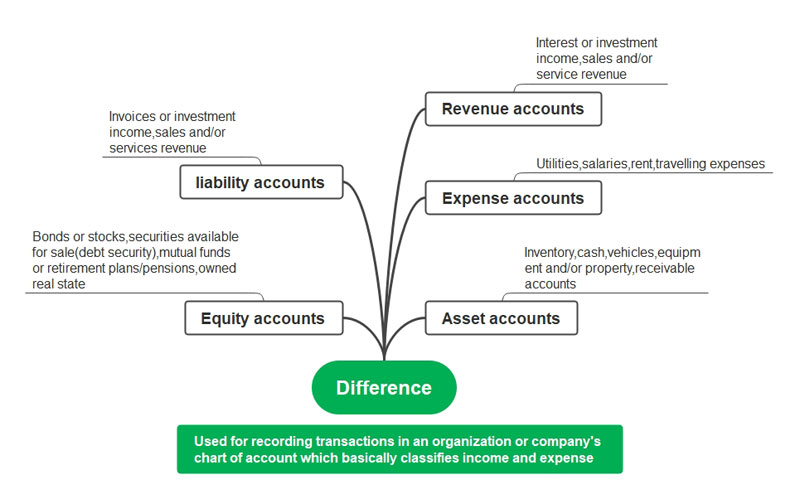

As previously stated, they are essentially used for recording transactions in an organization or company’s chart of an account, which basically classifies income and expenses. There are 5 major accounts in a company’s chart, which includes:

- Asset Accounts:Keeps track of items that will provide economic benefit to the company in the future. E.g., inventory, cash, vehicles, equipment and/or property, receivable accounts, etc.

- Expense Accounts:Keeps track of the charges that are used in the company’s day-to-day operations. E.g., utilities, salaries, rent, travel expenses, etc.

- Revenue Accounts: Keeps track of the income earned from the sales, i.e., products and/or services. This may also include interest from other investments. E.g., interest or investment income, sales and/or service revenue, etc.

- Liability Account:These are the dues that a company is required to pay back, in other words, the financial obligations that are pending on an organization. E.g. invoices for vendors, bills, tax, bank fees, other payables, etc.

- Equity Account:This is the total value of a company’s operational assets after the clearance of all the liabilities. E.g. bonds or stocks, securities available for sale (debt security), mutual funds or retirement plans/pensions, owned real state, etc.

To discuss an example of Debits and Credits, let’s say you want to add some new furniture to your office. But the thing is that for that, you will have to take a loan from the bank, so you decided to take a loan of $1000. Putting it in the context of debit and credit, we will have a chart that will look something like this:

| Account | Debit | Credit |

| Bank loan (liability) | $1000 | |

| Cash (revenue) | $1000 |

As we discussed at the start, it is all about balancing the sheets. Ultimately it is not all that difficult if you have a basic mind map to explain the basic concepts that surround the topic. This makes it easily comprehensible and helps to absorb and represent the knowledge much efficiently.