Understanding the Cash Flow Statement with Mind Maps

The statement of cash flows, or the cash flow statement, is a financial summary that sums up the measure of cash and equivalents of cash entering and leaving an organization. In this article, we'll show you how the cash flow statement (CFS) is organized and how you can utilize it while examining an organization.

Introduction

The cash flow statement (CFS) permits the investors to see how an organization's activities are running, where its cash is coming from, and how cash is being spent. The cash flow statement (CFS) is significant since it assists investors with deciding if an organization is on a strong monetary balance or not.

On the other hand, the creditors can utilize the cash flow statement (CFS) to decide how much cash is accessible (referred to as liquidity) for the organization to finance its working costs and pay its debts.

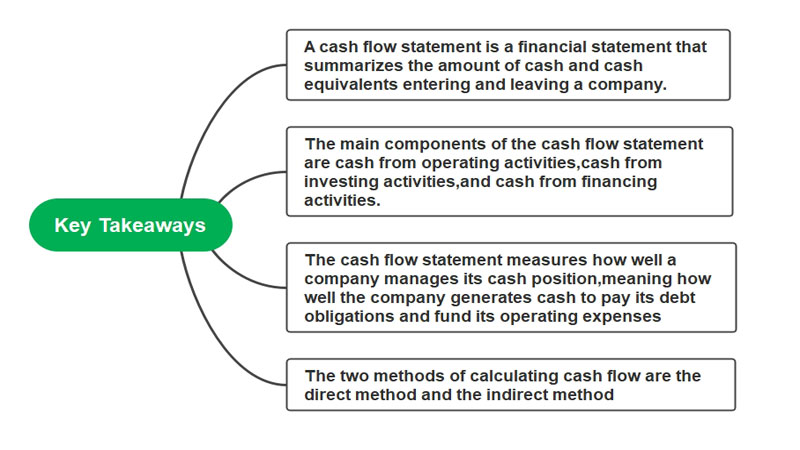

What Is the Cash Flow Statement?

A Cash Flow Statement (also called the Statement of Cash Flows) shows how much cash is produced and utilized during a given time. It is one of the primary budget record experts use in building a three statement model. The principle classes found in a cash flow statement are finance activities, operating activities, and investing activities of an organization and are coordinated separately. The total cash given from or utilized by every one of the three exercises is added to show up at the all-out change in cash for the time frame, which is then added to the opening cash balance to show up at the cash flow statement's main concern, the closing cash balance.

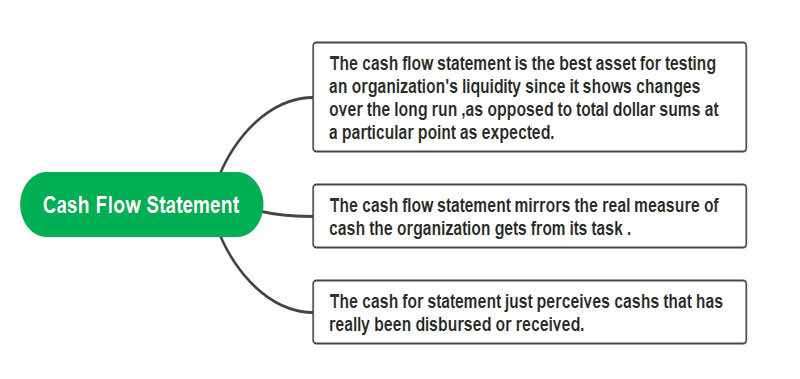

The Cash Flow Statement is the best asset for testing an organization's liquidity since it shows changes over the long run, as opposed to total dollar sums at a particular point as expected. It is additionally helpful in deciding the momentary feasibility of an organization.

One of the fundamental reasons cash inflows and outflows are noticed is to contrast the cash from tasks with overall gain. This comparison helps the organization, investors, management, and analysts to check how well an organization is running its activities. The cash flow statement mirrors the real measure of cash the organization gets from its tasks.

The purpose behind the contrast among cash and benefit is on the grounds that the income statement is set up under the basis of accrual of accounting, where it matches incomes and costs for the accounting time frame, despite the fact that incomes may really not have yet been gathered and costs might not have yet been paid. Conversely, the cash flow statement just perceives cash that has really been disbursed or received.

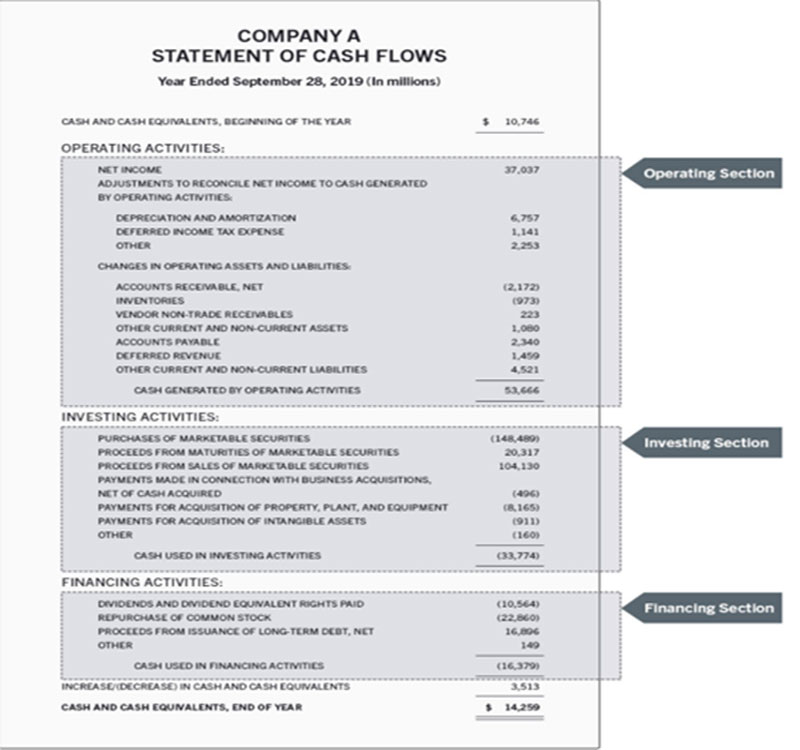

Example

Here is an illustration of a cash flow statement produced by a hypothetical organization, which shows the sort of data ordinarily included and how it's coordinated.

This cash flow statement shows Company A began the year with roughly $10.75 billion in cash and equivalents.

Cash flow is broken out into cash flow from operating exercises, financing exercises, and investing exercises. The business got $53.66 billion through its customary operating exercises. Then, it spent roughly $33.77 billion in investment exercises, and a further $16.3 billion in financing exercises, for an all-out cash outflow of $50.1 billion.

The outcome is the business finished the year with a positive cash flow of $3.5 billion and all-out cash of $14.26 billion.

Components of Cash Flow Statements

The Cash Flow Statement coordinates and reports cash in three divided classes: operating, investing, and financing.

- Operating Activities

This signifies the critical source of an association's generation of cash. It is considered by numerous individuals to be the most important data and information on the Cash Flow Statement. This segment of the Cash Flow Statement shows how much cash is created from an organization's center services or products. From the operational activities, the positive, solid cash flow (particularly over the long run) is a good indication of a sound organization. Operating activities begin with the net Income number from the Income Statement.

The greater part of these change things can either bring about an increment or lessening in cash from the operating exercises. Exemptions would be changes for amortization and depreciation, which are consistently an increment to net income on the cash flow statement.

Financing Activities

Changes in debits, credits or investment opportunities, long-run borrowings, and so forth are represented under Financing Activities. When capital is raised, it is considered as cash in; when profits are paid, or obligation is diminished, cash-out. The Financing Activities area shows what acquiring means for the organization's cash flow.

Importance of Cash Flow Statements

Without cash, your business won't operate, your workers get annoyed, and providers quit transporting you, and in all honesty, you can run out of cash while your business is truly productive and profitable.

The cash flows statement is significant on the grounds that it educates the reader regarding the business cash position. For a business to be fruitful, it should have adequate cash consistently. It needs cash to pay its costs, to pay bank advances, to make good on charges, and to buy new resources. A cash flow report decides if a business has enough cash to do precisely this. Other reasons why cash flow statement is important are

- Cash Flow Statements Help Determine Where the Money Goes

A profit and loss statement says nothing regarding payments that are principals and that you make to the bank. You could have sensibly great benefits. However, the measure of cash you pay your bank each month could be making you bankrupt.

Cash flow statements disclose to you where you went through your cash. On the off chance that you expanded stock, you utilized cash. If that you stretched out more credit to clients, you utilized cash. Or that you purchased bunches of capital equipment you utilized cash. Every one of the three of these issues won't appear on your benefit and misfortune statement.

- Cash Flow Statement Assist You to Focus On Creating More Cash

Having profits is significant. Profits are something that helps make cash. There are different things that can likewise assist you with making cash.

If that you can pay less for capital equipment you need, you are making cash while going through cash. If you can collect receivables from your clients quicker, you are making cash. In case you use stock all the more productively, you make cash. Focusing just on your benefit and loss statement makes it hard to focus on cash.

- Cash Flow Helps in Determining KPIs Better Than the Income Statements

Creating excess cash is an incredible Key Performance Indicator (KPI). This is a movement that, in a real sense, each department of your organization can engage in through individual drivers. Understanding what requirements to move the needle on benefits is just important for the story. Organizations that focus on making excess cash frequently likewise make preferred endeavor an incentive over those organizations that solitary focus on benefits.

- Cash Flow Help in Financing Decisions

Purchasing capital equipment utilizes cash. Developing limit in your organization utilizes cash. Adding stock uses cash. Adding clients utilizes cash.

The question is not that when we develop our organization is not whether we will utilize cash (we will). It's the way we are going to back our development. Now and again, you will simply utilize excessive cash provided from profits. In some cases, you will need to acquire cash from the bank. Now and then, you will have to raise outside capital.

Understanding where your cash goes and how you will give more cash when you need it are key aspects of running a fruitful organization. Understanding your cash flow statement will permit you to settle on better choices and decisions about your business.

Cash Flow Statements– Using The Indirect and Direct Methods

In order to sort out your organization's cash flow, you can take one of two courses: The direct strategy and the indirect technique. While generally accepted accounting principles (GAAP) affirm both, the indirect technique is regularly liked by private companies.

- Calculating Cash Flow Statement – Direct Method

Utilizing the direct technique, you track cash as it enters and leaves your business when utilizing that data toward the month's end to set up a statement of cash flow.

The direct method takes more preparation and organization than the indirect strategy. You need to deliver and follow cash receipts for each cash exchange. Thus, more modest organizations normally favor the indirect strategy.

Additionally, worth referencing: even if you record cash flows continuously with the direct strategy, you will likewise have to utilize the indirect technique to accommodate your statement of cash flows with your pay statement. In this way, you can, as a rule, anticipate that the direct technique should take longer than the indirect strategy.

- Calculating Cash Flow Statement – Indirect Method

With the backhanded strategy of the indirect method, you take a gander at the exchanges recorded on your income statement. At that point, switch some of them to see your working capital. You are specifically backtracking your income statement to wipe out exchanges that don't show the development of cash.

Since it is less difficult than the direct method, numerous independent ventures lean toward this methodology. Likewise, when utilizing the indirect technique, you do not need to return and accommodate your statements with the direct strategy.

For instance, deterioration is not actually a cash cost; it is a sum that is deducted from the complete estimation of a resource that has recently been represented. That is the reason it is added once more into net sales for figuring cash flow.

Conclusion

A cash flow statement is an important proportion of the long-term future, profitability, and strength viewpoint for an organization. The cash flow statement (CFS) can help decide if an organization has enough liquidity or cash to pay its costs. An organization can utilize a cash flow statement to foresee future cash flow, which assists with issues of planning.

By considering the cash flow statement, an investor can get away from how much cash an organization produces and gain a strong comprehension of the monetary prosperity of an organization.