Understanding The Income Statement with Mind Maps

A look at your income statement may disclose to you the amount you've spent in a specific timeframe and how much your business has made. To assist you with building up this agreement, here's a clarification of all you require to think about income statements.

Introduction

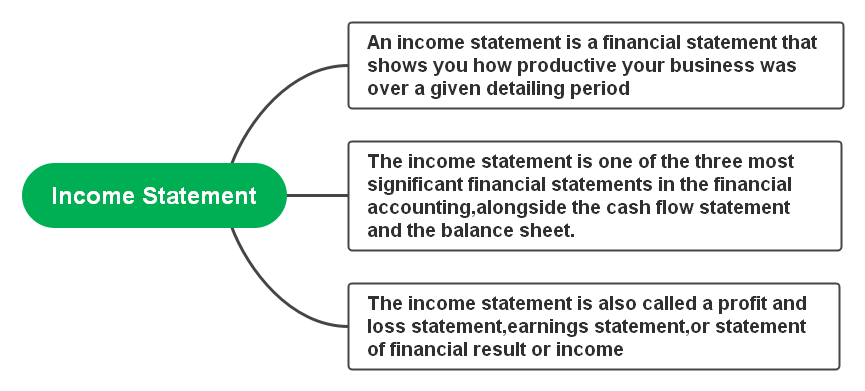

The income statement is one of the key financial statements arranged by most companies. It is a result-oriented report. As the name recommends, an income statement shows how much cash your business procured for a particular timeframe. Alongside the cash flow statement, balance sheet, and owner's equity, an income statement offers a decent gander at how your organization performed monetary for the month, quarter, or year.

In spite of the fact that the primary objective behind an income statement is to pass on profitability details and business exercises of the organization to the partners, it likewise gives definite experiences or detailed insights into the organization's internals for comparison across various sectors and businesses. The purpose of the income statement is to track the costs and revenues with the goal that you can decide the performance of the operation of your business throughout a period of time. Entrepreneurs utilize these statements to discover what areas of their business are plans that are over budget or what areas are under financial plan. Things that are specific and are causing expenses that come in unexpected can be highlighted, for example, supply costs, mail, fax, or telephone. Income statements can likewise track the sensational and dramatic increments in the cost of goods or product returns sold as a sales percentage. They likewise can be utilized to decide the liability of income tax.

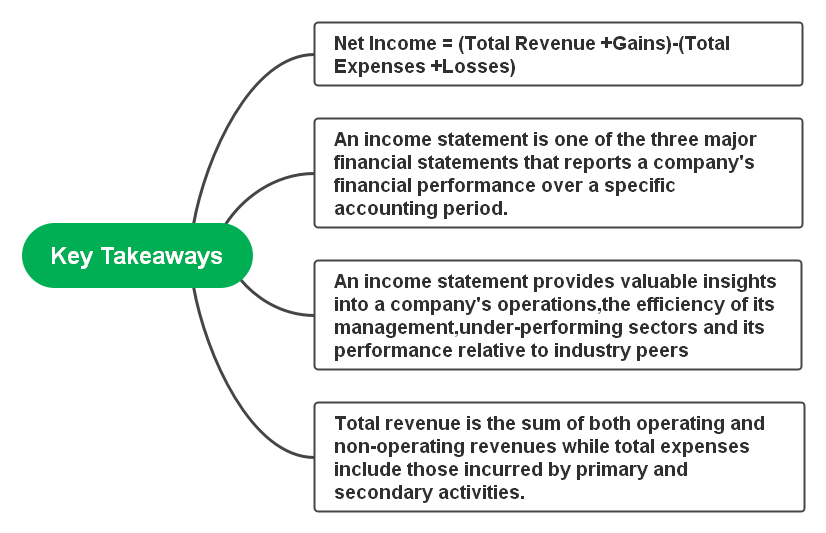

What Is an Income Statement?

An income statement is a financial statement that shows you how productive your business was over a given detailing period. It shows your income and expenditures, subtracting your losses and costs. The income statement is also called a profit and loss statement, earnings statement, or statement of financial result or income. The income statement is one of the three most significant financial statements in financial accounting, alongside the cash flow statement and the balance sheet.

Small businesses or the initial ventures regularly begin creating income statements when a bank or financial investor needs to perceive how beneficial their business is.

At the point when a business makes an income statement for the use of internal means only, they will in some cases allude to it as a profit or loss statement.

Income Statement Example

Here is a hypothetical example of an income statement created for a small venture – Coffee Bistro Enterprises Inc.

Coffee Bistro Enterprises Inc.

Income Statement

For Year Ended Dec. 31, 2019

| Category | Amount |

| Sales Revenue | $57,050.68 |

| Cost of Goods Sold (COGS) | $24,984.79 |

| Gross Profit | $32,101.89 |

| General Expenses | $11,049.55 |

| *Bank & ATM Fee Expenses | $9.43 |

| *Equipment Expenses | $742.40 |

| *Marketing Expenses | $503.53 |

| *Merchant Fees Expenses | $794.19 |

| Operating Earnings | $21,052.34 |

| Interest Expense | $5,000.00 |

| Earnings Before Income Tax | $16,052.34 |

| Income Tax Expense | $10,000.00 |

| Net Profit | $6,052.34 |

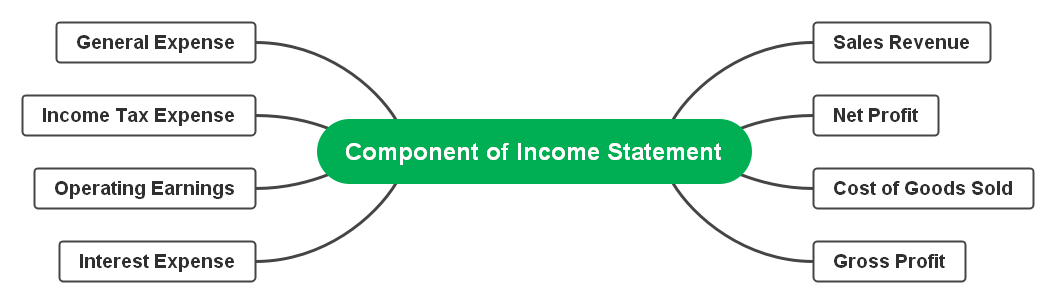

Components of Income Statement

Income Statements are intended to be perused thoroughly from top to bottom, so we should experience each line, beginning from the top.

- Sales Revenue

Each income statement starts with the revenue of the company. How you compute this figure will rely upon whether you do cash or accrual accounting and how your organization perceives income, particularly in case you are simply calculating revenue for only a month.

In general, this figure will only represent the total revenue for the time period the income statement is covering.

Cost of Goods Sold

Frequently abbreviated to COGS, this is the amount or cost to create out of the entirety of the services or products you offered to your clients.

Cost of goods sold (COGS) just includes direct costs like labor, shipping costs, and raw material costs. In case if you roast and sell something like coffee just as Coffee Bistro Enterprises, for instance, this may incorporate the expense of raw espresso beans, packaging, and wages.

Indirect costs like utilities, bank charges, and lease are excluded from COGS—we put those in a different classification.

- Gross Profit

This is the thing that you get when you deduct all out Cost of goods sold (COGS) from income or revenue. Gross profit discloses to you how beneficial your business is in the wake of considering direct expenses, however, prior to considering overhead expenses. It is a rough proportion of how effective your business is. There are two ways to how you can increase your gross profit: to decrease the amount of cost of goods sold (COGS) you pay or to increase the amount that your customers pay.

- General Expenses

Additionally, at times called operating costs or operating expenses, these incorporate lease, marketing and advertising cost, bank and ATM charge expenses, vendor expenses, equipment expenses, and some other costs you need to make in order to keep your business going.

These costs are listed independently here, yet some income statements will package these and other comparable costs together into one general class called Selling, General, and Administrative Expenses (SG&A).

- Operating Earnings

After considering all the internal costs this is how profitable your business is which you have more authority over, yet prior to considering the costs that are external like taxes and loan interest payments they are the ones you have less control over.

Accounts at times call this Operating Income or Operating Profit.

- Interest Expense

If your business owes somebody cash, it likely needs to make month to month interest payments like that in installments. Your interest expense is the absolute interest installments or payments that your business made to its lenders for the time frame covered by the income statement.

Earnings Before Income Tax

Prior to paying taxes, earnings before income tax is the profit of your business.

- Income Tax Expense

Income tax expense is the measure of the cost that a business perceives in an accounting period for the public government charge identified with its available taxable profit. The measure of income tax expense perceived is probably not going to precisely coordinate the standard income tax expense that is applied to business income since there are various differences between the reportable amount of income under the GAAP or IFRS structures and the reportable measure of income permitted under the relevant government charge code.

- Net Profit

Net profit is the estimation of an organization's profit once working expenses, interest, taxes, and deterioration have all been deducted from its all-out incomes. The term is regularly alluded to as an organization's bottom line and may likewise be portrayed as net income or net earnings.

Take away the expense of income tax and interest payments from your operating income, and you get the net profit. This is how much amount your organization acquired for the timeframe your income report covers.

If your complete costs exceed your income, your net profit will be in the negative. That implies you are working at a total deficit, that is, the net loss. For lean new businesses actually calibrating their technology and drawing in investment, incidentally working at a loss may not be something bad. For pretty much every other person, it is.

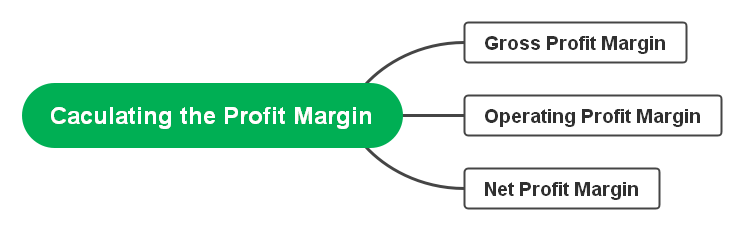

Calculating The Profit Margin

When you figure profit margins, you distill data to percentages from your income statement. A profit margin shows you the connection between the amount you spend and the amount you make. There are three most important margins in any business:

- Gross Profit Margin

Formula: Gross Profit Margin = (Total Revenue – COGS) / Total Revenue

Your gross profit margin discloses to you how much income your company makes for every dollar it produces after considering COGS.

- Operating Profit Margin

Formula: Operating Profit Margin = Operating Income / Total Revenue

Your operating profit margin is the part of every dollar your business keeps after considering both the COGs and general expense.

- Net Profit Margin

Formula: Net Profit Margin = Net Income / Total Revenue

Your net profit margin states to you what part of every revenue dollar you can bring home as net income. This considers every one of your expense—COGS, income tax, general expense, and interest payments

Importance of Income Statement

There are numerous reasons why independent companies and businesses, especially the new ventures, should plan income statements – and other financial statements. Here are a few reasons to explain the importance of the income statement.

- Help The Businesses to Prepare the File Tax

A small business and its proprietor are dependent upon different types of business charges. Paying these duties and taxes is compulsory by law. To guarantee what liabilities a business has, income statements and other budget reports help a great deal. Precise and updated income statements (alongside other finance reports) give an entrepreneur all the vital data they require to figure different taxes.

- Assist in Making Better Decisions

With a profit and loss statement available, an entrepreneur can take a gander at the past monetary performance of their organization. With fundamental information nearby, from profits to sales and working and non-working aspects, an entrepreneur will have the option to settle on better financial choices. By having exact figures, an entrepreneur can settle on quick choices and immediate decisions, which would somehow require problematic guesswork.

- A Proof to Business Success

Having income statements on paper implies that an entrepreneur can show an ordered record of how their business has been performing throughout the span of its existence. This eventually permits an entrepreneur to play the cards close to the stakeholders or with the purchasers if the owner of the business has the goal of selling the business. A Profit and Loss account likewise becomes helpful when new customers who wish to work together need a strong confirmation of a business' prosperity.

- Classification of Expenses and Revenues

The income statement likewise is significant because it explains the various expenses and revenues of an organization. Expenses and revenues are recorded by the business section from which they came. Non-business-related incomes and investment expenses, and revenues and costs are likewise recorded. This gives supervisors a perspective on how every division is performing so that if one department is failing to meet expectations, it can turn into the focal point of progress. It likewise gives the investors a superior thought of an organization's status by isolating its business incomes from gains on investments. This data considers a more point by point and detailed financial analysis of a firm.

Conclusion

Related to the balance sheet, annual; report, and cash flow statement help organization pioneers, experts, and investors comprehend the full image of a business' operational outcomes so they can decide its worth and proficiency and, preferably, anticipate its future direction.

Analysis of finances of an income statement can disclose that the expenses of products sold are falling or that the sales have been improving, while return on value is rising. Income statements are likewise painstakingly assessed when a business needs to cut spending or decide on techniques for development.

Figuring out how to peruse and comprehend an income statement can empower you to settle on more educated choices about a business, regardless of whether it's your own, your manager, or an expected venture.